5 Proven Investment Strategies to Navigate Market Volatility with Confidence

Market volatility is an inevitable part of investing. While it often triggers emotional responses that lead to poor decision-making, savvy investors recognize that volatility creates opportunities—if you have the right strategies and tools in place.

This guide explores five research-backed investment approaches that have consistently helped investors maintain confidence during turbulent markets and potentially turn volatility into advantage.

Disclosure: After evaluating dozens of investment tools and platforms, we’ve found that The Morningstar Investor Platform particularly excels at providing the data and analysis needed to execute the following 5 winning strategies that conquer market volatility—whether you’re a seasoned investor or just starting out. We may receive compensation if you sign up through our links.

1. The Quality Moat Strategy: Finding Stocks That Can Weather Any Market Storm

Companies with strong economic moats—sustainable competitive advantages that protect them from competition—have historically demonstrated resilience during market downturns and volatility. These businesses typically maintain pricing power, stable profit margins, and consistent cash flows even when economic conditions deteriorate.

However, identifying true economic moats requires deep fundamental analysis and access to comprehensive financial data that goes beyond surface-level metrics. Many investors struggle to differentiate between companies with temporary advantages versus those with durable, long-term competitive moats.

An elite-quality research tool like Morningstar’s proprietary moat ratings provide a systematic framework for identifying these advantaged businesses, categorizing companies as wide, narrow, or no-moat businesses. By screening for companies with wide or narrow moats, then further filtering by financial health ratings and valuation metrics, you can build a portfolio foundation of quality businesses that can potentially weather market volatility while delivering long-term returns. This can all be done quite easily through the Morningstar Platform.

Historical performance data consistently shows that wide-moat companies have outperformed the broader market over complete market cycles—particularly during recovery phases following significant downturns.

2. The Dividend Aristocrat Blueprint: Building a Reliable Income Machine in an Unpredictable Market

Dividend aristocrats—companies that have increased their dividends annually for at least 25 consecutive years—represent some of the most financially stable businesses in the market. These companies have demonstrated an ability to generate sufficient cash flow to reward shareholders through various economic conditions, including recessions, inflation spikes, and market crashes.

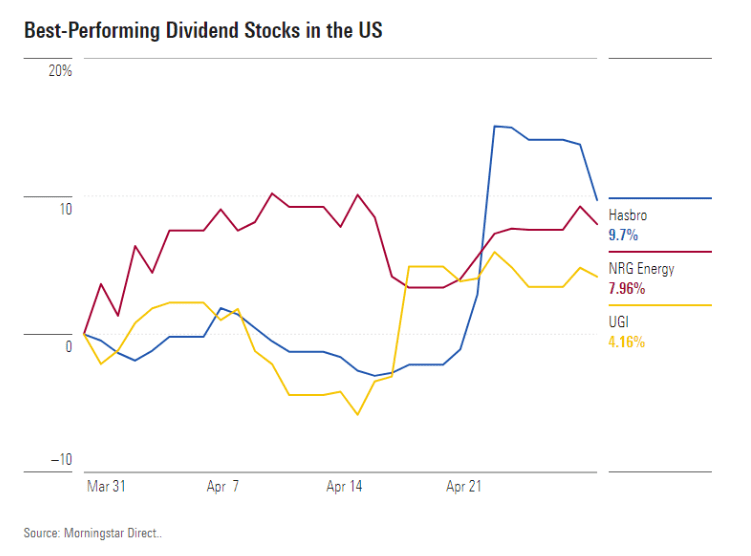

The challenge for most investors is properly evaluating dividend sustainability rather than simply chasing high yields. Many attractive-looking dividend stocks turn out to be yield traps, with unsustainable payout ratios or deteriorating business fundamentals that eventually lead to dividend cuts.

Comprehensive dividend data—including yield, payout ratios, growth rates, and sustainability metrics—is essential for building a reliable income portfolio. Morningstar’s dividend analysis tools can help you identify candidates that meet these criteria efficiently. By focusing on companies with moderate yields (3-5%), sustainable payout ratios (under 60%), and consistent dividend growth, investors can build an income-generating portfolio that also offers potential capital appreciation.

This strategy is particularly valuable in today’s market environment, where income sources remain at a premium despite higher interest rates, and can provide a psychological advantage during volatility as dividend payments continue regardless of short-term market movements.

3. The Valuation Gap Playbook: How to Spot Stocks Trading Below Their True Value

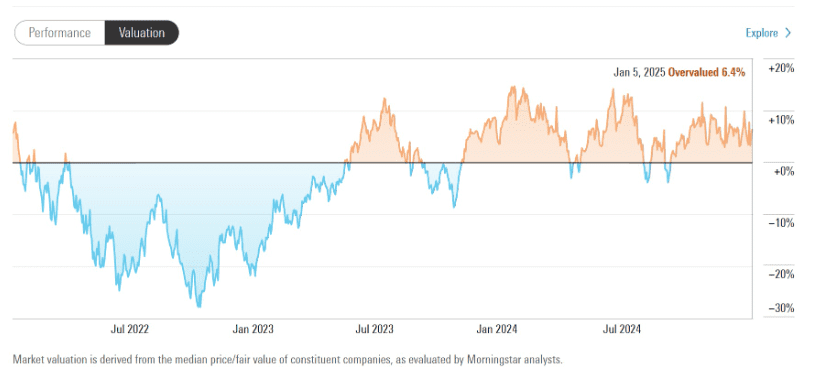

Value investing involves identifying companies trading below their intrinsic worth. Intrinsic worth is the present value of all future cash flows a company is expected to generate. When market price falls significantly below this fair value, a potential investment opportunity exists.

The primary challenge with value investing is determining a company’s true intrinsic value. Most investors lack the analytical framework, financial expertise, and time required to calculate accurate fair value estimates for hundreds of companies.

Professional fair value estimates, calculated through comprehensive discounted cash flow analysis, provide investors with clear target prices representing a company’s true worth. By screening for stocks trading at substantial discounts to their fair value estimates—essentially finding dollar bills selling for 70 or 80 cents—investors can identify potential bargains created by market volatility.

By applying additional quality filters, along with Morningstar’s highly acclaimed 5-star rating system and financial health indicators, you can identify undervalued companies with strong fundamentals rather than those that are cheap for good reason. This contrarian approach allows you to capitalize on market inefficiencies and short-term thinking that often accompany periods of volatility.

4. The Sector Rotation Roadmap: Positioning Your Portfolio for the Next Market Phase

Different economic sectors tend to outperform at different points in the business cycle. For example, consumer staples and utilities often excel during recessions, while technology and consumer discretionary typically lead during early expansion phases. By understanding these cyclical patterns and current economic indicators, investors can tactically adjust their sector allocations to potentially enhance returns.

The difficulty lies in accurately identifying which phase of the economic cycle we’re in, and which sectors are currently over or undervalued relative to historical norms. Without access to comprehensive sector-level data and analysis, investors often end up chasing yesterday’s winners rather than positioning for tomorrow’s outperformers.

Morningstar Investor’s Portfolio X-Ray tool provides detailed sector-level analysis, allowing you to see your exact sector exposures across all holdings in one comprehensive view. The platform offers sector weightings, valuation metrics, and performance data that help identify which sectors are poised for outperformance in the coming market phase. By monitoring key economic indicators alongside these sector valuation metrics, you can develop a proactive sector rotation strategy rather than reactively chasing performance.

This approach helps position your portfolio for coming market phases instead of simply responding to past movements. This is a crucial advantage during periods of heightened volatility when sector leadership often changes rapidly.

5. The ESG Integration Framework: Building a Portfolio That Performs While Aligning With Your Values

ESG investing focuses on companies with strong Environmental, Social, and Governance practices. Investors choose this approach not only to align their portfolios with their personal values but also because companies with strong ESG practices often demonstrate greater operational resilience and adaptability to changing market conditions.

Environmental, Social, and Governance (ESG) factors increasingly influence corporate performance and investor decisions. Companies with robust ESG frameworks typically show enhanced resource efficiency, stronger stakeholder relationships, and more effective risk mitigation strategies—potentially leading to superior long-term performance during market volatility.

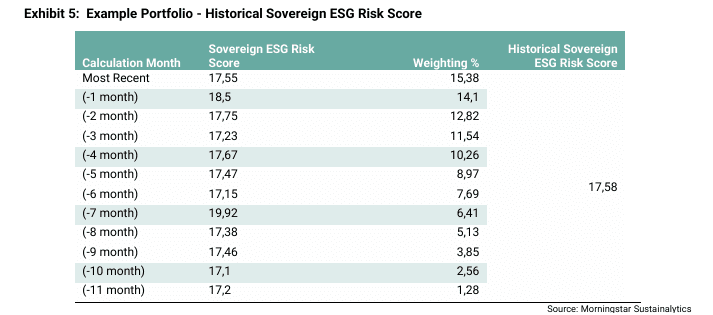

However, navigating the complex world of ESG investing requires robust data and analysis beyond what most individual investors can access or analyze. Many investors struggle to separate genuine ESG leaders from companies engaging in “greenwashing” or superficial ESG practices.

Morningstar Investor provides comprehensive ESG ratings and metrics through its Sustainalytics integration, a leading ESG research provider that Morningstar acquired to strengthen its sustainability offerings. The platform uses a multi-dimensional system that assesses both a company’s exposure to industry-specific ESG risks and how well it manages those risks. This approach helps identify best-in-class ESG performers across sectors, creating a well-diversified portfolio aligned with both your financial goals and values.

Research increasingly suggests that thoughtful ESG integration can enhance risk-adjusted returns rather than requiring a performance sacrifice—providing both financial and psychological benefits during market volatility.

Putting It All Together

Market volatility is inevitable, but your response to it doesn’t have to be driven by emotion or uncertainty. These five strategies provide a framework for navigating volatility with confidence and potentially turning market disruption into opportunity!

While implementing these strategies requires access to high-quality research, analytical tools, and comprehensive data, investors no longer need to build these capabilities from scratch. Platforms like Morningstar Investor combine all these tools in one integrated solution, giving individual investors the same analytical advantages previously available only to professionals.

This article was created by Stellar Investor. After reviewing multiple investment platforms, we found Morningstar Investor to be exceptionally well-suited for implementing these strategies. While we may receive compensation for featuring certain investment products, our recommendations are based on thorough research and a genuine belief in their value to our readers.

This article is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult with a qualified financial professional before making investment decisions.